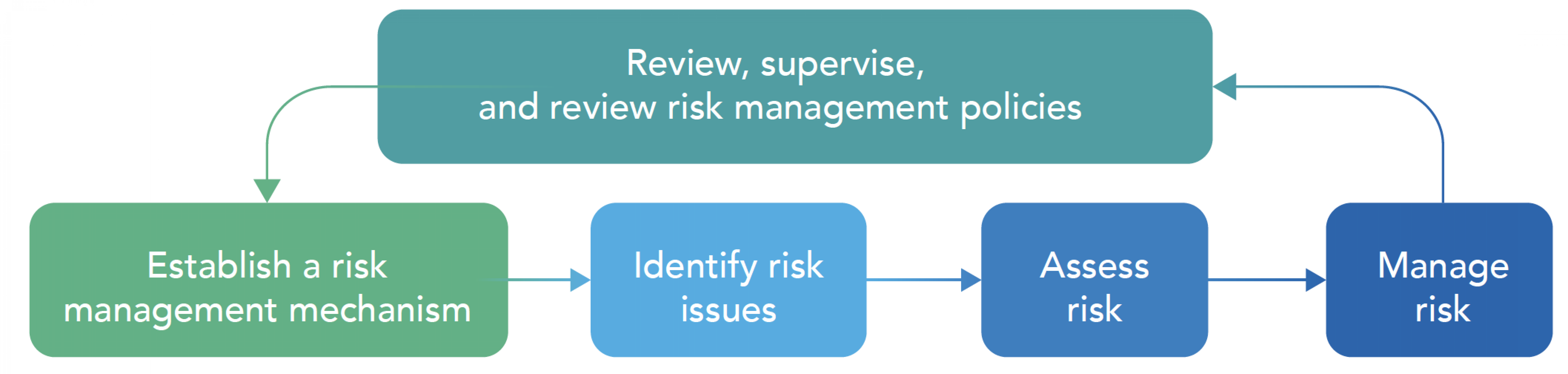

ESG Risk Identification and Management

Through the risk management organization, effective prevention and control of corporate risks are achieved, along with the identification of potential opportunities. Guided by the Company’s risk management policies, a collaborative assessment of both internal and external risks and opportunities is conducted.

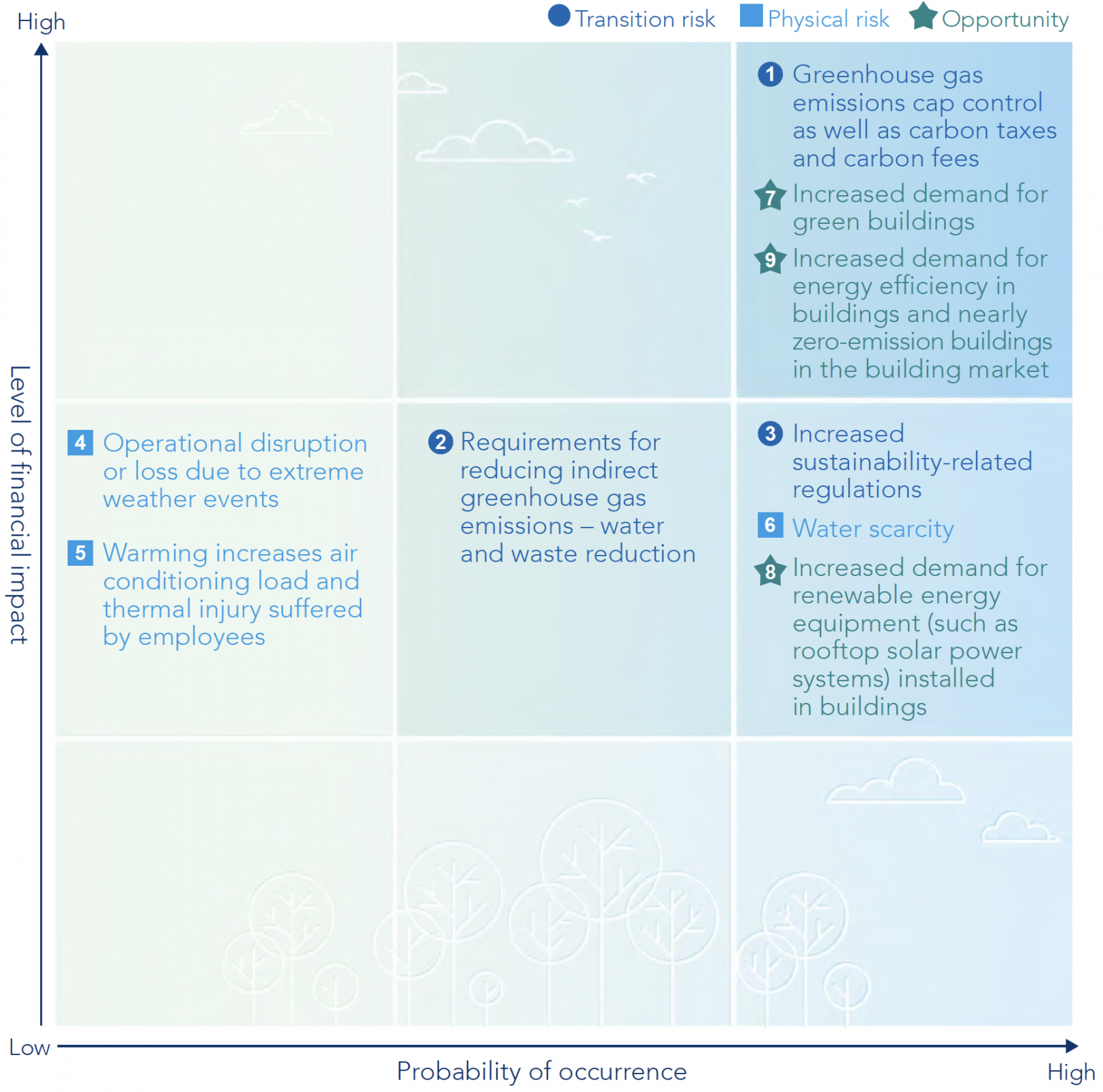

Risk Matrix

Climate Change Risk Assessment

With reference to the ISO 31000 Risk Management Guidelines, the potential harm caused by each risk is assessed using the following approach: Risk Level = Likelihood of Occurrence × Impact Level. This assessment employs the Delphi method, relying on the expertise of senior managers in relevant departments. The assessment identifies three primary transitional risks, three physical risks, and three opportunities. Likelihood of occurrence is further categorized into high, medium, and low levels, while the financial impact level is divided into high, medium, and low categories based on the proportion of actual capital. This process yields insights into the impacts of opportunities and risks on the Company.

ESG Risk Identification and Management

Through the risk management organization, effective prevention and control of corporate risks are achieved, along with the identification of potential opportunities. Guided by the Company’s risk management policies, a collaborative assessment of both internal and external risks and opportunities is conducted.

Risk Matrix

Climate Change Risk Assessment

With reference to the ISO 31000 Risk Management Guidelines, the potential harm caused by each risk is assessed using the following approach: Risk Level = Likelihood of Occurrence × Impact Level. This assessment employs the Delphi method, relying on the expertise of senior managers in relevant departments. The assessment identifies three primary transitional risks, three physical risks, and three opportunities. Likelihood of occurrence is further categorized into high, medium, and low levels, while the financial impact level is divided into high, medium, and low categories based on the proportion of actual capital. This process yields insights into the impacts of opportunities and risks on the Company.